Insurance sector gets nothing

Insurance sector will be badly impacted because of proposals in retrograde concerning insurance sector.

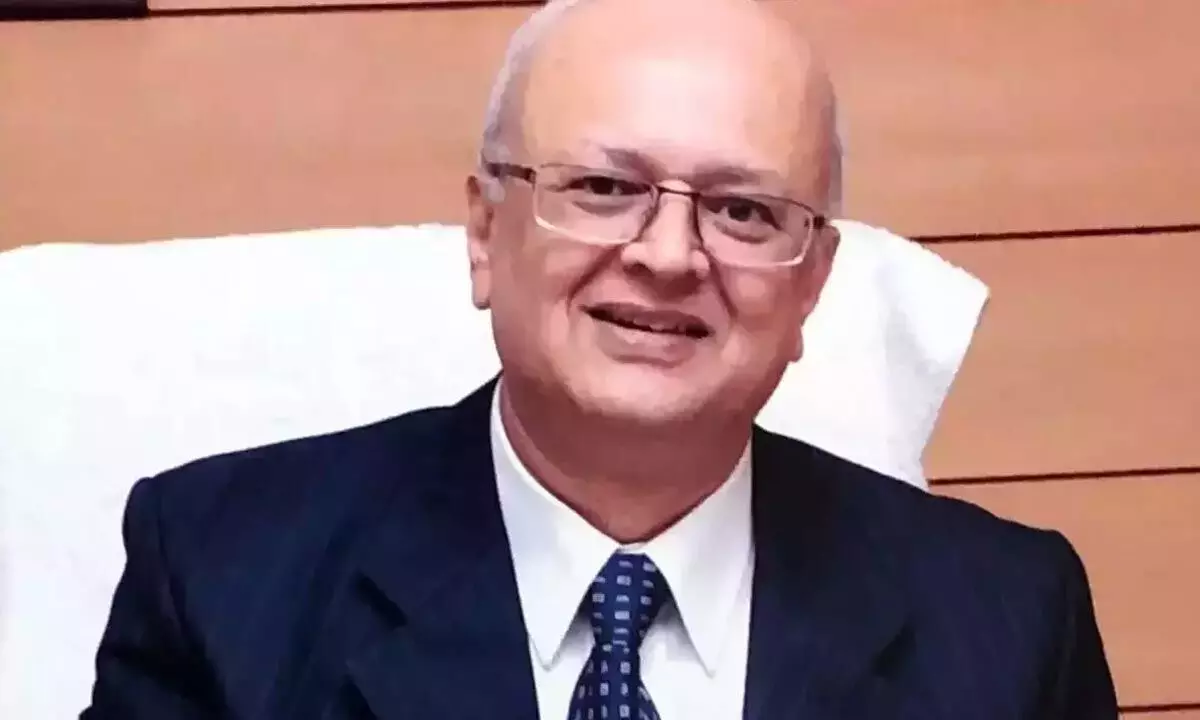

image for illustrative purpose

Mumbai: Insurance sector will be badly impacted because of proposals in retrograde concerning insurance sector. Talking to Bizz Buzz, Nilesh Sathe, former member, IRDAI, says: "The biggest blow is the announcement that income on policies where premium paid is in excess of Rs5 lakh will be taxed."

Again in the past, the central government had been taxing maturity proceeds (and not income which is maturity minus premium paid) on short term policies. So we shall have to wait to find how FM defines 'Income'. This will deflect savings from insurance to non-financial instruments which is a step in retrograde, he said.

Secondly, the income exempt limit under new tax regime is enhanced to Rs7 lakh, while there is no change under old tax regime. Even limits under 80 C /80 D have not been increased. Who will then opt for old tax regime? Instead of withdrawing the old tax regime, FM has created a situation by way of which old tax regime will become unwanted. Old regime was offering tax relief for savings. FM wants people to spend rather than save, he added.

Thirdly, contribution in NPS gets favourable tax treatment which is denied to pension contributions in Insurance policies. This has not been corrected. Overall, he said, increasing penetration in insurance is going to be a nightmare.

The biggest blow is the announcement that income on policies where premium paid is in excess of Rs5 lakh will be taxed

- Nilesh Sathe, former member, IRDAI